What Must the Policyowner Provide to the Insurer for Validation That a Loss Has Occurred?

Daniel is a retired business concern executive who now devotes most of his free time to trading stocks and stock options in the stock market.

Unfortunately, there is no company (yet) that will take on the risk of offering stock loss insurance to investors. Merely despite the absence of an organization that offers protection against stock losses we can notwithstanding do then past using an innovative method of providing this insurance ourselves.

How? With stock options!

Stock Options as Insurance Protection

Yes, stock options have this special characteristic of protecting stock investments and information technology is beingness widely used past both private and institutional investors on a regular basis.

Protective coverage can be total or partial depending on how much protection one desires. Just like any other kind of insurance, full coverage is extremely expensive.The more protection one takes the college the insurance premium. In fact, with some kinds of insurance, it is not possible to learn one hundred percent full protection even if i is willing to pay a very high premium. The insurance company just won't take on the adventure.

Similarly, using options equally insurance protection against stock loss, it is possible to give oneself ample insurance coverage simply probably not 100 percent total protection. Before proceeding farther on this subject permit'south talk near who needs coverage against stock losses.

Who Needs Coverage Confronting Stock Losses?

In nigh cases where an investor uses options as insurance protection, it is with the intention of protecting PROFITS. It is the turn a profit already earned that i wants to safeguard confronting loss. Plainly, the best way to safeguard earned profit is to liquidate the stock and pocket the profit.

But in many instances, either because of man's natural tendency to be greedy or the desire to earn greater profits, the investor wants to concord on to his stock in the promise that the bounty will continue. In this event, it makes sense to have on some kind of protection confronting a reversal in the market. There are several ways one can practise this.

Buy Puts Mug

Method No. 1 - Ownership Puts

This is the easiest, fairly common, most effective simply almost expensive method of stock loss protection. If you already have some basic knowledge of how options work you should know that buying puts gives y'all the right to sell your stock at a predetermined price no matter how low the stock price may drop.

Example: If you had bought Accelerate Micro Devices (AMD) in the early part of 2016, say in April, the price of the stock and then was $2.lxx and if you lot had bought 1,000 shares your total investment was $2,700. Today, October 2017, every bit this article is written, the stock is currently going for $13.23. Your $2,700 investment has now ballooned to $thirteen,230 for a total net profit of $10,530.

You discover yourself in a quandary. Do you liquidate your position at present and accept home the profit already gained or should you stay in the game and hope that AMD continues its upward trend?

You lot make up one's mind to hold on to the stock for another calendar month and see how AMD performs during this period. In the concurrently, you protect your profits by buying puts equally a hedge against the potential occurrence of a reversal in price.

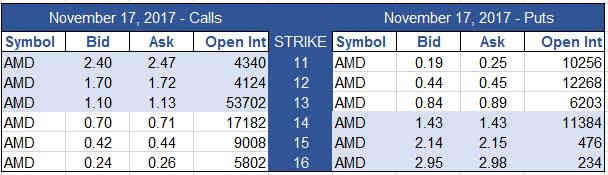

You expect at AMD's option concatenation table below and see what put options are available.

The third week of Nov looks practiced and you determine that put xiv strike (contract price) works for you. This means that you are guaranteed to sell your AMD shares at $14 no matter how depression the stock price drops. This insurance is valid until the tertiary Friday of November at which time you accept to decide whether to sell your stock at $xiv bold the stock has dropped below $14. Or, if the stock is higher than $xiv you could continue to hold on to your shares and buy new put insurance.

Looking at the option chain below the November fourteen put has an ask cost of $i.43. Equally you know you pay the ask price when buying and sell at the bid price when selling stocks or options. Yous pay a total of $1,430 for your insurance. A strong toll to pay for merely almost 30 days of insurance coverage. But a pocket-size price to pay for sleeping well at night with the assurance of profit protection.

Roll to Continue

Read More From Toughnickel

You lot are guaranteed to be able to sell your AMD stock at $14 per share no matter how low the stock may driblet all the way up to the third Fri of November when your insurance (put option) then expires.

At present let'southward move on to the other methods of insuring your stock against loss.

Method No. two - Selling Covered Calls

This is the more economical way of getting insurance for a stock that has risen in value. The drawback hither is that you are limited to any potential continued ascent in the price of the stock.

As you know buying a call option gives you the right but not the obligation to buy the stock at a predetermined price for a given menstruation of time in the future. And then as a seller of a call option, you have the obligation to sell stock at a predetermined price on or earlier the expiration of the option.

Since as a seller you are compelled to sell your stock at a fixed agreed price (the option strike toll) y'all are therefore limited to sell the stock at that cost no affair how high the stock continues to ascension in cost. This is one of the downsides to this cheap insurance.

The other downside is that the insurance this method offers is rather small if the stock price goes on a swift downwardly slide. You lot are only covered by the same corporeality of the premium you received from the call pick sale. More about this in the paragraph following the instance beneath.

The upside is that you lot don't pay for this insurance and in fact collect money in the process. And this is why covered phone call writing or covered call selling is also well known equally a means of generating revenues from ownership of stock.

Covered call writing is actually used more than for its power to generate income from stock ownership rather than as protection or insurance coverage against a drib in the stock price.

Example: Using the same scenario of AMD stock you lot are in deep profit with the stock now trading at the current price of $13.23. Looking at the option chain in a higher place you could sell the Nov xiv call at the bid price of $0.lxx and collect $700 for x contracts (one contracts is 100 shares).

You have just generated an income of $700 from your stock but you lot accept also created a ceiling of $14 on the price at which you accept to sell the stock. If the price continues to climb higher than 14, say fifteen, xvi, 17 or more, yous will non participate in the higher prices since you have committed to sell your AMD shares at the agreed strike price of 14.

In that location is, of course, a system of circumventing this limitation by using the roll-out procedure of endmost and rolling expiring options. The curlicue-out process is described in detail in i of my other manufactures on the HubPages website.

More than than the limitation of college cost do good the greater downside to writing calls every bit insurance is its inability to protect confronting a connected drop in stock cost.

If AMD were to lose steam and start dropping in its price y'all have no protection beyond the cost of the call you sold. Meaning yous are only protected upwards to $0.seventy of price drib which was the amount you got when you sold the telephone call or $12.53 (13.23 current price less 0.70 sold call). Below $12.53 you are losing your profits for every point drib.

To sum up I would non consider call writing every bit a good means of insurance confronting a reversal in the price of a stock. But call writing is an excellent strategy every bit a means for generating income from your stock.

Method No. iii - Initiating a Terminate Loss Society

I believe there is non much I need to say about how i uses this feature to limit potential loss on a stock. This is perhaps the most widely used safeguard against loss from a drop in stock price.

The problem with this feature is that a stock is in constant flex, going up and down all the time. If the 'terminate-loss' price is besides close to the current market price it could be triggered prematurely and the investor would then be out of the game. The stock could then turn around and continue college thereby losing for the stockholder the opportunity for greater profits.

Method No. 4 - Ownership Call Options

In this method, one exits his stock position by selling all his shares at a profitable price and using a small portion of his earned profits to purchase long-term call options. The goal is to yet be in the game should the stock proceed its strong performance.

Using AMD over again as our instance, with its current price now at $xiii.23 yous could just sell off the stock and use part of the $10,530 earned turn a profit to pay for a long-term call option expiring say, six months from today.

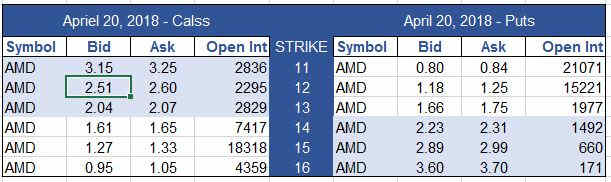

In the starting time insurance method described in No. 1 to a higher place, yous bought puts to safeguard your stocks spending $1,430 for insurance coverage of just a little over xxx days. By liquidating your stock and using $1,485 of your profits you could buy 9 contracts of the April 2018 calls with strike xiv at an enquire price of one.65 (see the Apr 2018 selection chain below). While you are spending simply slightly more than buying puts as in No. 1, your April calls provide insurance coverage of half dozen months instead of only about one calendar month with the put options.

The main difference between this method and that of No. i is that with this method you are belongings only call options while with No. i you lot notwithstanding own shares in AMD. Owning the shares will give you more profit potential than the call options.

How?

If the stock cost continues to appreciate merely at a much slower stride you volition yet continue to increase your gains penny for penny or dollar for dollar if you owned the stock. This would not be true with the call options that you bought at an OTM price. Due to fourth dimension decay, your call options will slowly lose value as time passes.

So unless the stock goes on a dramatic and aggressive price rise within the next half dozen months the call options will eventually lose value or appreciate very little. Only since call option value appreciation was non your intention in the first place merely only as a corollary benefit to the insurance coverage information technology therefore matters little if it does not capeesh at all.

1 other advantage of continuing to own the stock using insurance Method No. 1 is that if it were a stock that pays regular dividends (AMD does not), yous would keep to receive dividends as long as you own the stock.

At present we get into the final of the various methods of stock loss insurance.

Method No. 5 - Initiating A Neckband Spread

Here is where it gets somewhat more complicated. By definition, a collar spread is an options trading strategy where one who owns shares of an underlying stock buys protective puts and simultaneously sells call options to offset the cost of the purchased puts. In short, it is a technique of using covered call options to finance the cost of buying the protective puts described in Method No. i.

If y'all wanted to buy a longer, more expensive put insurance, say 6 months validity, instead of just 1 calendar month equally mentioned in Method No. i, y'all could do so paying only a small-scale minimal premium.

Yous could buy the 2018 April strike 13 put for 1.75 and sell the April 14 call for ane.61 thus paying only 0.fourteen for the six months of protective coverage or a total of only $140 for all of your ane,000 shares. But this limits your upside to a maximum price of only 14 at which price you must sell your stock. Of grade, y'all could sell the April 15 or sixteen calls thus increasing your upside limit but you would exist increasing your premium payments also. If you bought the April 13 put at one.75 and sold the April 16 call at 0.95 then the premium you pay would be a net $0.80. The stock would take to go up to $xvi before your Apr 16 call is exercised.

So there you take it. Five dissimilar strategies for insuring your stock portfolio against losses.

NOTE:

Any and all information pertaining to trading stocks and options including examples using actual securities and price information are strictly for illustrative and educational purposes only and should non be construed as consummate, precise or current. The writer is not a stockbroker or fiscal advisor and equally such does not endorse, recommend or solicit to buy or sell securities. Consult the advisable professional advisor for more complete and electric current information.

This article is accurate and true to the best of the author's knowledge. Content is for informational or entertainment purposes but and does not substitute for personal counsel or professional advice in business organization, financial, legal, or technical matters.

Questions & Answers

Question: What is the best method for protecting my stocks against losses?

Respond: I suggest you read the commodity advisedly once more. Information technology shows the pros and cons of each insurance method depending on your risk tolerance, profit goals, and investment objectives. Consequently, it would be difficult for me to propose to yous what is the best insurance method.

Question: How much college would AMD stock have to rise to recover the cost of the put insurance in Method No. i?

Reply: From its current price of $13.23, AMD's stock cost would have to get upwardly to $14.66 to compensate your put insurance price of $1.43.

© 2018 Daniel Mollat

Source: https://toughnickel.com/personal-finance/insurance-against-loses-in-stocks-really

0 Response to "What Must the Policyowner Provide to the Insurer for Validation That a Loss Has Occurred?"

Post a Comment